Insurance Solutions: Protect Your Total Wealth Picture

You’ve spent a lifetime building your wealth and planning ahead for your family’s well-being. Safeguard these assets with insurance that complements and advances your broader wealth management goals.

Financial Breakthrough offers access to specialized insurance guidance and broad-ranging coverage options to help you protect what matters, both now and as your needs evolve. Our strategic insurance partners work hand-in-hand with your advisor to integrate coverage into your comprehensive financial plan.

IS THIS YOU?

I’LL GET LIFE INSURANCE TOMORROW?

MAYBE TODAY?

NEXT YEAR?

Service that simplifies your life

Insurance is a fundamental part of keeping you on track to achieve Economic Freedom. However, achieving the ideal mix of insurance coverage on your own can quickly grow complex and time-consuming. Without a trusted partner who can see how insurance fits into your total wealth picture, you risk overlooking crucial gaps and cost-saving opportunities.

We created our transparent, hassle-free insurance offering to bring clients greater peace of mind and help simplify their lives. Our dedicated strategic partners handle all of the legwork involved in reviewing your needs, finding the optimal policy options from a broad slate of nationwide carriers, and helping keep your coverage up to date.

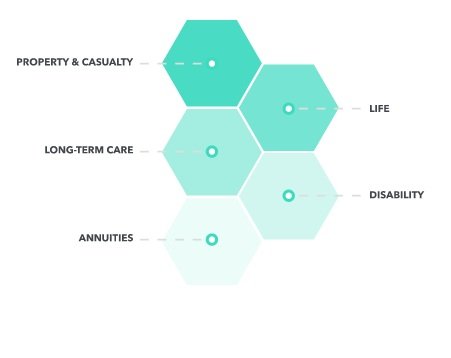

Our insurance solutions include:

Trusted guidance from a team that knows you

While many RIAs and financial planners provide insurance and risk management services, few integrate insurance into their broader wealth management offering. Instead, they typically refer clients to third parties who have little to no insight or control over the client experience. Financial Breakthrough takes a more proactive approach, helping our clients identify and execute insurance solutions that meet their needs and are more tightly linked to their financial plan. By integrating our insurance solutions partners with our holistic Family Wealth Service offering, Advisors helps ensure that all dimensions of your wealth management strategy are aligned to achieve your long-range goals.

And as a fiduciary to our clients, we always put your best interests first. Our Insurance Solutions guidance is carrier-agnostic, which means we focus 100% on finding you the highest-quality coverage that best meets your needs.

Coverage that fits you exactly

In concert with our Insurance Solutions specialists and our strategic partner, your local financial advisor can match insurance solutions to every other pillar of your comprehensive financial plan.

Our teams collaborate to:

1

ASSESS YOUR SPECIFIC NEEDS

Your advisor starts with an initial assessment and review of your current insurance coverage and risks. We use those findings, along with your overall financial plan, to identify potential coverage gaps, opportunities, changes, or additions.

2

DESIGN YOUR IDEAL INSURANCE PORTFOLIO

The initial assessment is provided to our strategic partners who then conduct a more in-depth analysis using sophisticated technology to compare policy offerings from dozens of carriers. This analysis helps determine which provider can offer the most optimal coverage, and the best solution, from a high-quality company that meets your needs. The analysis and recommendation are reviewed with your advisor to ensure it aligns with your overall wealth management plan and then shared with you during a one-on-one meeting.

3

KEEP YOUR COVERAGE UP TO DATE

As part of Financial Breakthrough’ commitment to review our clients’ investment portfolios and other financial plan details on a regular basis, your advisor will set up ongoing insurance check-in meetings with you. We look at any recent changes in your assets, your current financial situation, and your long-range goals to help determine whether any coverage changes are needed. You gain simplicity, peace of mind, and the assurance that the proper coverage supports your broader wealth objectives.

Your source for seamless insurance solutions

You and your advisor have worked hard to build a personalized financial plan for growing your assets and achieving your long-term goals. How you choose to protect those assets should be just as strategic and aligned with your overall wealth management strategy.

We provide you with a one-stop shop for insurance coverage that aligns seamlessly with your wealth management strategy and your personal vision of financial wellness.