Comprehensive Financial Planning

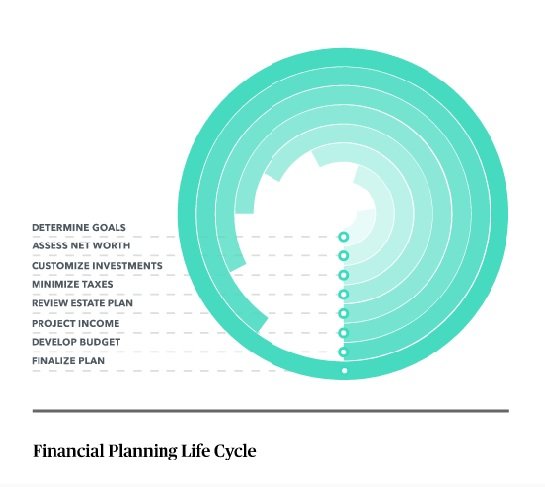

Financial planning is the foundation for your entire financial journey. It connects all the components of a comprehensive wealth management plan, including investments, taxes, estates, and corporate trusts, acting as a roadmap to help ensure your long-term goals are met. For example, if you want to retire early, a financial plan will help you determine what you need to save annually, the investment returns required, and the overall net worth you need to obtain in order to maintain your desired lifestyle in retirement.

As a Financial Breakthrough client, you will work with a financial advisor who leads the client team, including a CERTIFIED FINANCIAL PLANNER™ professional. CFP® professionals have thousands of hours of experience providing comprehensive financial planning services, passed a rigorous examination, and are held to strict fiduciary and ethical standards.

What to expect when working with a Financial Breakthrough comprehensive financial planner

Financal Breakthrough Comprehensive financial services range from developing a financial plan to investing your money to tax planning and return preparation, estate planning, retirement planning, and more. Whatever your financial situation, our advisors are professionally equipped to handle your personal finances to help you attain your Economic FreedomTM.

A financial advisor provides advice on your investments, such as retirement accounts, estate, taxes, and children’s education plans. Here are a few examples of financial planning services that may be included when working with Mercer Advisors:

- Investment management: Investing your life’s savings is serious business. We believe investing is a means to an end, and it all starts with your financial plan. We believe high-quality financial planning services are a prerequisite to a successful investing experience. Our factor-based investment philosophy is based on academic research.

- Estate planning: From foundational estate planning basics to intricate planning issues such as complex assets (a business), complicated family situations (you and your spouse have children from a previous marriage), or other circumstances (special needs or medical issues), our estate planning attorneys work in concert with our advisors to help you prepare for countless life scenarios.

- Tax planning: When you work with an accountant to prepare your taxes, or if you file your tax return yourself, you look at the past year and how your finances were impacted. Financial Breakthrough Advisors takes a proactive approach to tax planning to help you better understand what your tax situation may look like in the future and how the decisions you make today can affect your future wealth.

- Retirement planning: A comprehensive approach to retirement planning considers tax planning, investment management, estate planning, and much more. Our team of professionals analyze and develop strategies to help you set and meet your retirement goals.

- Education planning: Higher education is expensive. If you want to help your children or dependents pay for college, financial planning can help.

- Budgeting: A financial planner will propose a budget based on your personal situation to help guide you in your spending according to your financial situation.

The exact services offered by a financial planner will vary based on the individual. Make sure your financial advisor offers services that address your needs.

Your Financial Advisor Will:

Listen to your individual situation to uncover your financial goals and consider all your wealth management needs, from lifestyle and retirement to charitable giving and legacy.

Prepare and analyze your balance sheet, including net worth, cash flow planning, saving, and budgeting.

Manage your investments, income taxes, retirement, estate plans, and children’s education plans, and show you how it all works together to help you achieve Economic Freedom™ and peace of mind.

Identify potential risks to you and your loved ones so that you may keep more of your wealth and don’t have to worry about you or your family’s financial future.

Lifestyle, Longevity, and Legacy Protection

Why is financial planning so important?

Help you achieve your desired lifestyle

Wealth longevity

Create your desired legacy

- How do I protect my assets to ensure my children inherit the maximum amount?

- If I die unexpectedly, who will take care of my children?

- How do I ensure my legacy is passed on to my favorite charity?

With Financial Breakthrough, you gain a Comprehensive financial planning partner who can help you protect those who matter most and what you’ve worked so hard to build. We’re here to listen to your “What if?” and your “What now?” questions.